About the Greenhouse Gas Reduction Fund

The Inflation Reduction Act (IRA) created the Greenhouse Gas Reduction Fund (GGRF), a $27 billion investment to mobilize financing and leverage private capital for clean energy and climate projects that reduce pollution. GGRF is focused on ensuring benefits reach low-income and disadvantaged communities. For additional information on GGRF, see the Local Infrastructure Hub’s Introduction to GGRF.

GGRF funds three programs:

- The National Clean Investment Fund (NCIF)

- The Clean Communities Investment Accelerator (CCIA)

- Solar for All

Each program will award funds to qualified lenders by December 2024. Lenders will start issuing loans and providing financing to cities and other entities by spring 2025, at the earliest.

NCIF and CCIA will provide financing for “qualified projects” that meet the following criteria:

- Reduce greenhouse gas emissions.

- Reduce other air pollutants.

- Deliver benefits to communities.

- May otherwise not have been financed.

- Mobilize private capital.

- Support only commercial technologies.

CCIA funds have additional requirements. All CCIA funds must be spent in low-income and disadvantaged communities (this is also true for a portion of NCIF funds) and be for projects in one of three “priority project categories”:

- Distributed energy generation and storage.

- Net-zero emissions buildings.

- Zero-emissions transportation.

Solar for All funds can be used for residential rooftop and residential-serving community distributed solar projects for low-income and disadvantaged households.

How Cities Can Use GGRF Financing

GGRF financing can be used to provide up-front capital for greenhouse gas reduction projects.

Financing is provided at below market rates and can take the form of loans (including low or zero-interest loans, bridge loans that provide up-front cash for funds that will be refunded through direct pay tax credits, etc.), equity, combinations of loans and equity (e.g., mezzanine debt), or credit enhancements like loan guarantees.

Cities will apply for GGRF financing through GGRF lenders or, in the case of the CCIA, through hub nonprofits, not through the EPA itself.

| Example GGRF-Eligible City Projects | Example GGRF Financing |

| A zero emission retrofit of a municipal building or school | Low-cost, long-term financing at below market rates from Climate United, an NCIF grantee |

| Adding rooftop solar to multifamily low-income housing owned by the city | Solar for All loan from state energy agency OR NCIF awardee Coalition for Green Capital |

| City fleet electrification | Small low-cost loan through a local CDFI via CCIA |

| Installing public EV charging stations | Small bridge loan from a local credit union to pay the upfront costs eventually recouped through elective pay tax credits |

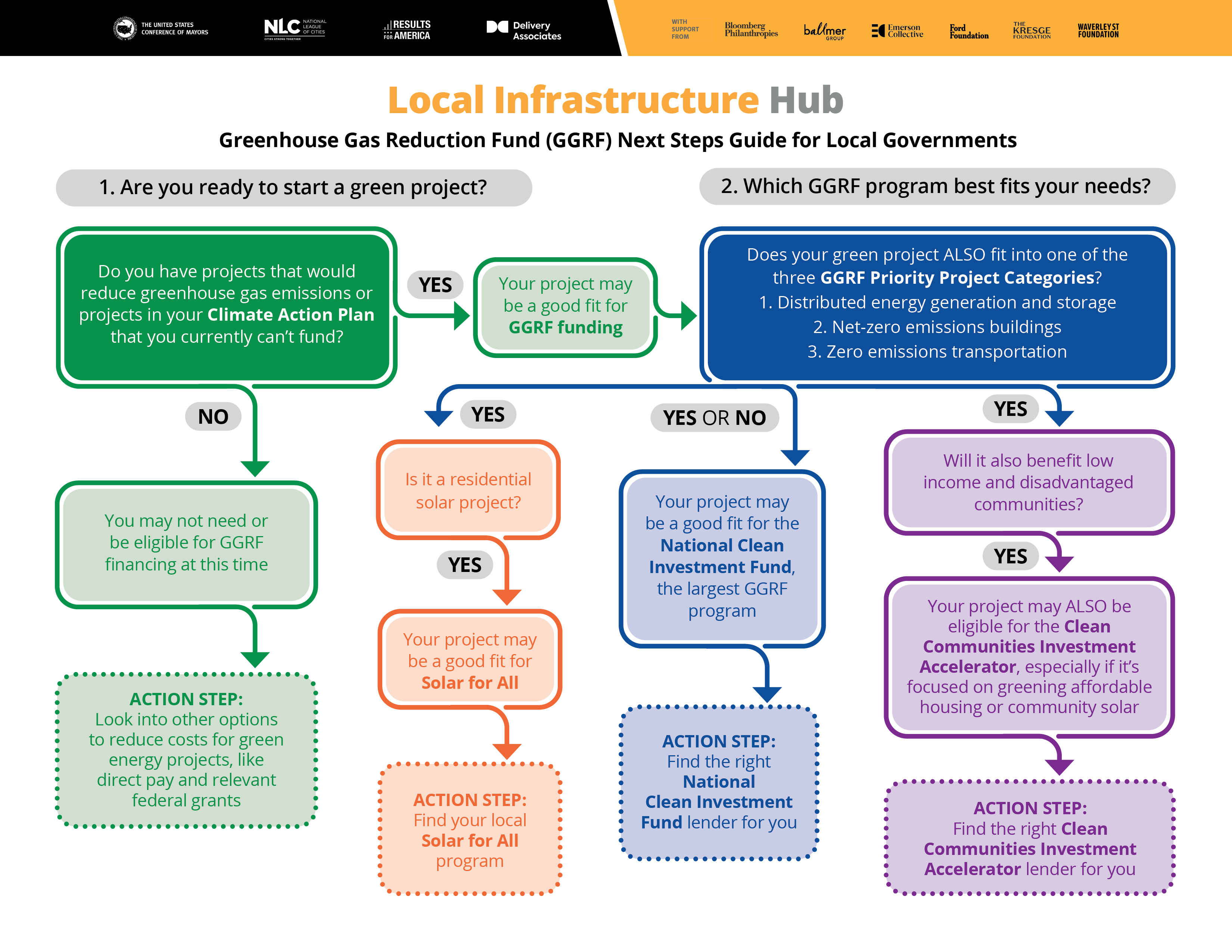

The below chart can help you understand which GGRF program is right for you and what next steps to take.

If your action step was to find the right NCIF lender for you…

NCIF provided $14 billion total to three nonprofits that will function as national green financing institutions for clean energy projects. Each of the recipients has a slightly different focus and area of expertise.

To learn more about the similarities and differences between the NCIF lenders, register for the LIH webinar on NCIF, currently scheduled for October 2024 – register here.

- Climate United Fund (CUF)

- Geography: National

- Market segments: Consumers, multi-family housing, community infrastructure, small businesses and small farms, schools and minority-serving institutions, community solar, and electric vehicle infrastructure.

- Coalition for Green Capital (CGC)

- Geography: National

- Market segment: Consumer, commercial, small business and nonprofits, and affordable housing developers. For tax exempt organizations like local governments, CGC may also provide or support the third-party provision of bridge financing for tax credits.

- Power Forward Communities

- Geography: National

- Market segment: Affordable housing

If your action step was to find the right CCIA lender for you…

CCIA works differently from NCIF in that the U.S. Environmental Protection Agency provides funds to “hub nonprofits,” national organizations that are networks of community lenders. The funding is then passed along to local and regional community lenders like credit unions and community development financial institutions (CDFIs), who in turn provide financing to eligible projects.

To learn more about the similarities and differences between the CCIA hub nonprofits, register for the LIH webinar on CCIA, currently scheduled for December 2024 – register here.

The hub nonprofits that will be establishing CCIA programs are:

- Opportunity Finance Network (OFN)

- Geography: Low-income and disadvantaged communities served by OFN’s national network of CDFIs.

- Market segments: Community solar and wind, residential rooftop solar, commercial small scale solar, and standalone storage. Zero emissions buildings in single-family residential, multi-family residential, community locations, commercial (including industrial, agricultural and municipal.) Zero emissions vehicles, including residential electric vehicle charging stations at/near multi-family housing and EV Charging Depots.

- Inclusiv

- Geography: Low-income and disadvantaged communities served by Inclusiv’s national network of credit unions.

- Market segments: Consumer loans for residential solar installations, home electric vehicle charging stations, and energy efficient appliances; real estate lines of credit for decarbonization retrofits of homes and commercial properties; zero emissions vehicle loans; and business loans for community solar, charging infrastructure, and micro-grid projects.

- Justice Climate Fund (JCF)

- Geography: Low-income and disadvantaged communities served by the JCF network of community lenders, which includes African American, Hispanic or Latino, Native American and Asian-focused organizations.

- Market segments: None specified beyond priority project categories.

- Appalachian Community Capital

- Geography: Low-income and disadvantaged communities that are rural, in the Appalachian region, and/or energy communities (communities impacted by coal mining, oil extraction, or other industries harmful to the environment)

- Market segments: Decarbonization of multifamily residential and commercial and industrial buildings; distributed clean power generation; and zero emissions transportation such as public electric vehicle charging infrastructure, school buses, and commercial trucks.

- Native CDFI Network (NCN)

- Geography: NCN’s network of 60 Native CDFIs, with a presence in 27 states

- Market segments: Distributed energy generation, net-zero buildings, and zero emissions transportation projects in Native communities.

If your action step was to find a Solar for All program…

Rather than providing funding for a small number of GGRF lenders like the other two programs, Solar for All provides a grant to an organization or entity in nearly every state to set up a program to deliver residential solar projects to low-income and disadvantaged households.

Most states except for Alabama, Delaware, Iowa, Kansas and Oklahoma will be setting up their own Solar for All programs. If you are located in a state that does not have its own program, there are national and multistate providers that will serve you (even if your state has a program, you can also apply to one of the multistate providers if you are within their geographic service area.) There are also grantees that will serve tribal lands. You can find more details about each Solar for All program and relevant contact information here.

To learn more about this program, register for the LIH webinar on Solar for All, currently scheduled for March 2025 – register here.