Clean Energy and direct Pay Overview

Cities across the United States are working to advance a clean energy transition, which is crucial to reducing carbon emissions and meeting climate goals. As part of the Inflation Reduction Act (IRA), the federal government recently developed a new financial tool called Direct Pay (also called Elective Pay) to incentivize clean energy investments. Direct Pay will provide direct financial assistance to cities, non-profit organizations, and other tax-exempt entities to defray the costs associated with a range of clean energy investments via tax rebates.

Considerations for municipal leaders looking to leverage Direct Pay

- Does the municipality have a climate action plan? If not, what steps need to be taken to develop one? If yes, does it need to be updated since initial adoption?

- Which projects and/or purchases are eligible for Direct Pay tax credits, and which credits are they eligible for?

- What strategies can the municipality use to finance projects ahead of receiving rebates?

- Does the municipality plan to take advantage of increased or maximum rebate amounts available if certain requirements are met (prevailing wage, domestic content, and energy community bonuses)?

- How will the tax rebates be accounted for in annual budget documents and what local approvals/process will be necessary?

- What is the municipality’s strategy for securing an initial capital investment to fund projects that are eligible for the Direct Pay rebates?

- How will the city engage leaders across the various departments involved in planning/implementing projects and receiving the tax credits (finance/budget, sustainability, community development)?

The Climate Projection Fund

Project Leadership:

- Mayor Mike Johnston

- Elizabeth Babcock; Executive Director, City and County of Denver’s Office of Climate Action, Sustainability, and Resiliency (CASR)

- Former Mayor Michael Hancock

- Denver City Council

Location: City and County of Denver [Consolidated government]

Focus: Climate, Direct Pay

Overview

In November 2020, Denver voters overwhelmingly approved a ballot measure to create the Climate Protection Fund (CPF) to raise approximately $40M per year dedicated to climate action via a 0.25% local sales tax. Projects funded through the CPF include the purchase and installation of a heat pump at a Green Spaces coworking space, Mile High Youth Corps’ Energy and Water Conservation Program, and community solar gardens.

Since passage of the Inflation Reduction Act (IRA), Denver is planning to supplement the fund with Direct Pay rebates for eligible projects.

While the Administration and U.S. Treasury use ‘Direct Pay’ and ‘Elective Pay’ interchangeably, for the purposes of this case story we will use ‘Direct Pay.’

Lessons for Other Cities:

- Review climate action/local sustainability plan and priorities; ensure that it is up to date, reflecting new opportunities from the IRA

- Foster collaboration across departments where climate action plans and investments engage various departments

- Ensure that investments/projects comply with requirements for applicable bonus tax credits

- Determine how Direct Pay rebates will be reflected in the local budget and identify a method for financing up-front capital costs

Projected Impact

Denver Takes the Lead

As the largest city within a 500 mile radius, Denver understands their responsibility to spearhead climate action to influence the broader region and protect the environment and health of those in Denver as they strive to achieve net zero goals. Through the Climate Protection Fund, the city is leading the way in financing climate action projects and leveraging new federal resources.

Developing Denver’s Financing Mechanism

Denver’s 2018 Climate Action Plan established an initial goal of reducing greenhouse gas (GHG) emissions by 80% by 2050 from a 2005 baseline. To achieve their goal, Denver decided to focus on the top three sectors with the largest impact and best opportunities for GHG reductions across the city buildings, electricity generation, and transportation.

In early 2019, Resilient Denver, a resident-led grassroots organization, successfully mounted a signature effort to put an energy tax on the 2019 ballot. Through a deliberative process with then Mayor Michael Hancock and Denver City Council, the organization tabled the ballot measure, providing time for the city to create a Climate Action Task Force and the Office of Climate Action, Sustainability and Resiliency (CASR).

The task force urged Denver to adopt more ambitious goals, including a 100% reduction of greenhouse gas emissions by 2040. The task force’s final report estimated that recommended climate action investments would yield at least $20.3B in benefits through savings and averted impacts at a cost of $3.4B over the ensuing decade.

After exploring different financial mechanisms to raise funding to advance Denver’s climate action and sustainability goals, the task force came to the consensus that a sales tax would be more equitable than an energy consumption tax. In making the recommendation, the task force acknowledged concerns with the fact that sales taxes are generally considered regressive, but noted that exemptions to the sales tax in Denver for medical supplies, food and water, fuel, and feminine hygiene products help to ease the burden.

In line with the recommendation, the Denver City Council moved to put the question of a 0.25% local sales tax to a vote. On November 3, 2020, Denver voters passed the 0.25% sales tax to form the Climate Protection Fund with 62.3% of the vote.

Denver Climate Action Task Force

With support from the Bloomberg Philanthropies American Cities Climate Challenge, the task force made recommendations to strengthen Denver’s efforts to address climate change equitably in a range of areas, including transportation, buildings, energy consumption, resilience and adaptation, and 100% renewable electricity. The task force included 26 members from a range of organizations, including Resilient Denver, student advocates, energy and real estate sector networks, labor, and faith communities.

Through their work, the task force engaged with over 4,000 members of the public and collected thousands of comments. This included various engagement strategies like the Consider.it Online Engagement Tool, social justice and equity site visits, stakeholder advisory group meetings, community-based facilitated sessions, and two rounds of Meetings in a Box.

Climate Protection Fund

The sales tax dedicated to the Climate Protection Fund is projected to generate approximately $40M to the Fund annually, subject to economic fluctuations, to fund programs intended to reduce emissions and increase sustainability and climate-resiliency. The CPF was established as a non-lapsing special revenue fund managed by the CASR, and per the ballot measure, spending is limited to six allowable uses. As a non-lapsing special revenue fund, the Fund’s balance accrues and remains available for spending. The ballot measure also requires that at least half of the revenue generated by the local sales tax go to equity-focused projects.

Allowable uses for CPF:

- Workforce development for clean energy technology and natural resources management

- Investments in solar power, battery storage, and other renewable energy technology

- Neighborhood-based environmental and climate justice programs

- Adaptation and resiliency programs for vulnerable communities

- Sustainable transportation investments

- Energy efficiency upgrades for residential, commercial, and industrial properties

The CPF is composed of several funds – including funds for capital projects, federal and state grants, and most recently, the Climate Federal Revenue Operating Fund, where the CASR Office intends to reinvest the Direct Pay tax rebates from eligible projects.

Through the fund, CASR has invested in municipal and community solar installations at public properties (e.g., libraries, public schools, municipally owned buildings), ground source heat pumps, battery storage, and EV charging infrastructure. Recent examples of their projects include the completion of their latest community solar garden in partnership with Denver Public Schools at Northeast College High School, where they installed a 309 kW solar carport with electric vehicle charging infrastructure; this is part of a $26M investment in community solar gardens from the Climate Protection Fund. When completed, this new solar garden, alongside 11 other community solar gardens, will produce 9.6M kWh per year, avoiding emissions equivalent to taking 1,000 cars off the road. 45% of the generated electricity from these arrays will support low-income households through Denver Public Schools and the Denver Housing Authority; this is expected to save participating families $700 per year.

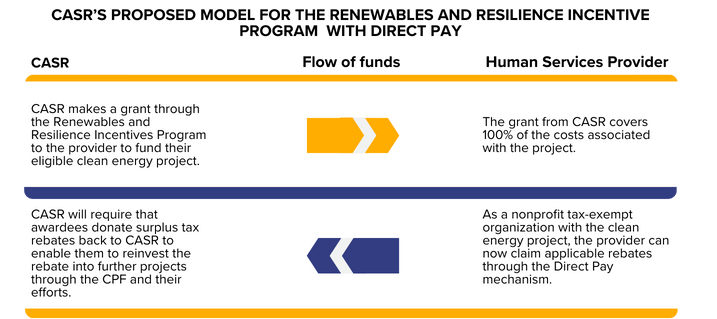

CASR also uses the CPF to support non-profit human services providers as they install solar and battery storage infrastructure through the Renewables & Resilience Incentive Program for Human Service Providers. Through this grant program, CASR has supported solar installations at the Colorado Coalition for the Homeless’ new Recuperative Care Center, an electric vehicle charging station at Colorado Family Church, and a 70 kW solar installation at the Bill Daniels Veterans Service Center, in addition to several other similar projects.

All of the aforementioned investments, and more, are eligible uses for the IRA’s Direct Pay credits. While revenues from the sales tax provided for greater funding than initially anticipated, CASR has still faced limitations in what they can do as they seek to support municipal agencies’ efforts to electrify fleets, become more energy efficient, and adopt renewable energy sources. The passage of the IRA and implementation of the Direct Pay provisions is expected to increase CASR’s capacity to support agency efforts as they reinvest the rebates.

Innovating for Greater Direct Pay Impacts

While the city can spend the Direct Pay rebates they claim for CPF projects at their discretion, they are taking an approach of responsible stewardship by setting aside the rebates in a Climate Federal Revenue Operating Fund. This fund, as established by the City Council, can only be spent by CASR on projects relating to building electrification, energy efficiency, solar and battery storage, electric vehicle charging infrastructure, and clean energy transition studies. Per CASR staff estimates for 2023-2025, the city will see Direct Pay values of over $20M for projects costing an estimated $54M. This will give them greater financial capacity for the CPF, and allow their investments to have a greater impact, providing environmental, societal, and financial benefits.

Additionally, CASR is working to leverage their grant program to enable further reinvestment into the CPF portfolio. Through the Renewables and Resilience Incentive Program, CASR provides grants to nonprofit human service providers to support clean energy investments; as nonprofit entities, these human service providers are also eligible for the Direct Pay rebates. In the program, CASR is adopting language that creates a contractual obligation by which awardees use Direct Pay benefits to 1) refund their organization for funds spent on their eligible investment project before 2) refunding remaining IRA rebates to the city to enable stewardship of the fund and allow for longer-term investments.

This approach of incorporating Direct Pay into the CPF enhances the fund’s resilience to economic shock over time and allows for greater resource accumulation over the years. Since the Direct Pay reimbursements are not limited by the ballot measure that directs the overall CPF, CASR can reinvest tax rebates in climate action projects at their discretion, and they hope to use some of this funding to support the efforts of municipal agencies for their own climate action investments. Elizabeth Babcock, CASR Executive Director, noted that this would alleviate pressures on the general funds for municipally driven projects such as fleet electrification.

The linkage between the CPF and Direct Pay rebates also address an upcoming challenge for cities around the timing of the rebate. The rebates can only be claimed for projects that are in service and cannot be claimed prior to that point. As such, eligible entities looking to use Direct Pay will need to identify a revenue or financing stream that will cover the initial investments. Denver is addressing that issue by linking it to the revenue stream created by the 0.25% local sales tax.

Conclusion

In 2020, Denver city government and residents laid an important climate action foundation with the passage of a local sales tax that provides for community wide investments in climate projects. The passage of the IRA in 2022 presented the city with a mechanism to leverage the existing revenue stream and investments to create greater opportunity. As a result, the city is planning to effectively create a revolving fund by which they can continue to advance their climate action projects and goals across many needs and entities for years to come. Not every city will be able to create a dedicated fund and revenue stream for climate action; however, every city is eligible for the Direct Pay tax credits and has the potential to leverage the rebates, and other federal resources, to invest in clean energy projects that will advance broader goals towards reducing emissions and combatting the effects of climate change.

Accelerator for America would like to thank Drexel University Nowak Metro Finance Lab for their partnership in production of this case story for the Local Infrastructure Hub.