Cities across the United States are working to advance a clean energy transition, which is crucial to reducing carbon emissions and meeting climate goals. As part of the Inflation Reduction Act (IRA), the federal government recently developed a new financial tool called Direct Pay (also called Elective Pay) to incentivize clean energy investments. Direct Pay will provide direct financial assistance to cities, non-profit organizations, and other tax-exempt entities to defray the costs associated with a range of clean energy investments via tax rebates.

With this in mind, the Local Infrastructure Hub is highlighting two cities for their work in climate action and consideration for Direct Pay rebates: Madison’s municipal fleet transition and Denver’s Climate Protection Fund.

In Madison, WI, the city is investing in greening their municipal fleet by transitioning to light/medium duty electric vehicles and heavy-duty vehicles fueled by state-sourced biodiesel. Their procurement of EVs, installation of the charging infrastructure, and related grid work will be funded in part by reinvested Direct Pay rebates. Fleet electrification is an initiative being adopted in cities across the country, and the story of Madison is an illustrative example of that process and how Direct Pay can support it.

In Denver, a 2020 ballot referendum established the Climate Protection Fund with revenue generated by a local 0.25% sales tax. The fund, administered by the Office of Climate Action, Sustainability, and Resiliency, provides for investments in climate action projects and workforce development programs. The LIH case story on Denver illustrates how the fund originated and the office’s plans to reinvest Direct Pay rebates generated by their projects to grow the fund’s capacity.

Considerations for municipal leaders looking to leverage Direct Pay

- Does the municipality have a climate action plan? If not, what steps need to be taken to develop one? If yes, does it need to be updated since initial adoption?

- Which projects and/or purchases are eligible for Direct Pay tax credits, and which credits are they eligible for?

- What strategies can the municipality use to finance projects ahead of receiving rebates?

- Does the municipality plan to take advantage of increased or maximum rebate amounts available if certain requirements are met (prevailing wage, domestic content, and energy community bonuses)?

- How will the tax rebates be accounted for in annual budget documents and what local approvals/process will be necessary?

- What is the municipality’s strategy for securing an initial capital investment to fund projects that are eligible for the Direct Pay rebates?

- How will the city engage leaders across the various departments involved in planning/implementing projects and receiving the tax credits (finance/budget, sustainability, community development)?

This case story is one in a series designed to highlight and bring to life stories of impactful infrastructure projects around the country funded by or eligible under programs within the Infrastructure Investment and Jobs Act (IIJA) or Inflation Reduction Act (IRA). The story you are reading focuses on fleet electrification and Direct Pay eligibility per the IRA. The provisions for Direct Pay support localities in their efforts to advance sustainability and climate action projects.

The Local Infrastructure Hub is highlighting Madison, Wisconsin’s municipal fleet electrification.

Click HERE to visit the resources page of the Local Infrastructure Hub to see other case stories and resources. You are currently reading the Madison case story, to access the Denver case story click here.

Project At A Glance

Leadership

- Mayor Satya Rhodes-Conway, Madison, WI

- Deputy Mayor Christie Baumel, Madison, WI

- Mahanth Joishy, Superintendent, Madison Fleet Services

Location

City of Madison

Timeline

2018 – Ongoing

Focus

- Climate

- Direct Pay

Project Description in Brief

Since 2018, the City of Madison has been investing in transitioning their 1,400 vehicle municipal fleet to alternative fuels with the goal of having all light/medium duty vehicles be electric, and the heavy duty vehicles running on biodiesel. To date, they have been using local and state resources to fund and finance the fleet electrification – the passage of the Inflation Reduction Act (IRA) provides an opportunity for Madison to tap into new funding sources to accelerate this project, through Direct Pay and new grant programs like Charging and Fueling Infrastructure.

Under her Capital Improvement Program (CIP) for FY 2024 through FY 2029, Mayor Rhodes-Conway’s FY 2024 Capital Improvement Budget (CIP) identifies $13 million in Direct Pay tax credits to support a range of investments through FY 2029, including Madison’s municipal fleet transition, as well as solar and geothermal energy projects.

While the Administration and U.S. Treasury use ‘Direct Pay’ and ‘Elective Pay’ interchangeably, for the purposes of this case story we will use ‘Direct Pay.’

Funding Sources

For FY 2024 through FY 2029, Madison is planning to use $70.3M in government obligation borrowing (for EV procurement and charging infrastructure) and local support from partners, including the University of Wisconsin-Madison and Madison Gas & Electric, to fund the fleet transition. Madison’s CIP also includes $13M in Direct Pay rebates that are being reinvested in these projects, including $372K for their EV transition.

Prior to the availability of funds from the IRA, Madison has used local and state sources, including two grants totaling $139K from the Wisconsin State Office of Energy Innovation for EV procurement and charging infrastructure, which allowed them to purchase their fleet’s first EVs.

Project Dates/Timeline

The city’s goal is to have all municipal vehicles on 100% alternative fuels by 2030.

Projected Community Impact

Madison’s Fleet Transition Plan

The City of Madison developed a sustainable transportation master plan in 2017, Madison in Motion, which provided recommendations for a sustainable transportation system and pilot projects for new technologies related to the transition.

Madison’s 2018, 100% Renewable Madison report, which sought to lay out the path for a zero-emissions Madison, found that “vehicle emissions from the City of Madison and Metro Transit account for a third (34%) of the carbon footprint from City of Madison local government operations.” The city fleet alone consumes 709K gallons of diesel and 450.9K gallons of gasoline, resulting in about $2M in annual spending on transportation fuels.

The report made several recommendations for reducing emissions; those specific to the city’s fleet include:

- Right-sizing vehicles,

- Operator training,

- Reducing idle time,

- Sharing best practices within and across communities, and

- Switching to alternative fuels, including biodiesel, propane, landfill CNG, and electricity.

The city’s fleet transition started in 2018 with a biodiesel fueling program. Under the leadership of Mahanth Joishy, the City’s Fleet Services Superintendent, Madison is making significant progress towards their 2030 goal of having all of their light/medium duty vehicles (900) replaced with an electric fleet by 2030, and the heavy duty vehicles (500) converted to 100% biodiesel or other cleaner sources.

Progress to Date

As of publication, the Madison city fleet has 109 fully electric vehicles, having just purchased their 100th electric vehicle in October 2023. Their fleet includes Chevrolet Bolts, Nissan Leafs, off-road vehicles, and the first electric fire truck in North America. The city also has 150 hybrid-electric vehicles in their fleet, 16 utility vehicles (forklifts and sweepers) that run on propane, and all diesel vehicles are now operating on biodiesel fuel. They also have 40 electric vehicles on order, including three all-electric garbage trucks.

Madison is also investing in charging infrastructure. Given that the city’s fleet is based and operating within a small radius (city limits), they have determined that a two to one ratio of vehicles to chargers is appropriate – this allows them to charge vehicles in between duty cycles or overnight. Thus, the city has 60 chargers which have been installed on city properties, including six off-grid solar chargers at the city’s new, sustainable Fleet Services building.

First Electric Fire truck

Madison’s fire department had the opportunity to test out the Pierce Volterra pumper at their busiest station over an 18-month period; they were one of three fire departments in the country to collaborate and provide data to assist with the final development, evaluation, and on-highway certification processes. After the 18-month placement, the city made a purchase order for the pumper in February 2023, becoming the first city to purchase an electric fire truck in North America. Through reduced diesel fuel usage, the pumper is expected to eliminate over 31.8 metric tons of CO2 emissions every year.

While Fleet Services has been responsible for the procurement of alternative fuel vehicles for their fleet, the City Engineering Department took responsibility for establishing the City’s EV charging infrastructure. For their charging infrastructure work, the city has been working with Madison Gas & Electric, the local utility, as well as Dane County, RENEW Wisconsin, and other local communities to develop a cohesive charging network.

Together, these organizations submitted a joint grant application for USDOT’s Charging and Fueling Infrastructure program to support public charging stations throughout Madison and Dane County. As of the publication of this report, USDOT’s Charging and Fueling Infrastructure Grant awards were not yet announced. In addition to the Charging and Fueling Infrastructure program, fleet electrifications like the one in Madison may also be eligible for Climate Pollution Reduction Grants and Greenhouse Gas Reduction Fund programs.

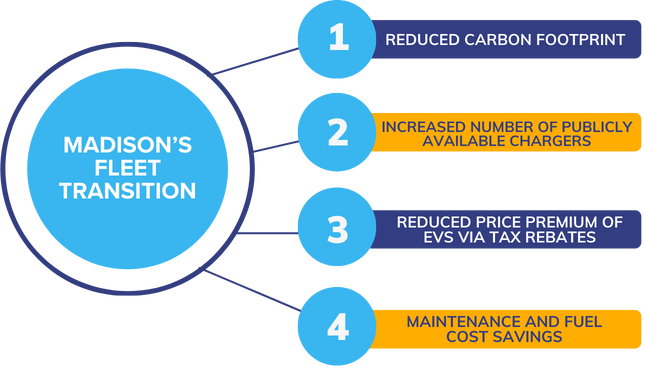

Community Impact

The Madison Fleet transition, alongside their Metro Transit transition, will greatly reduce their portion of the city’s carbon footprint – contributing to the community’s broader efforts at addressing climate change and related health impacts. Since starting in 2018, Madison’s fleet transition has reduced carbon dioxide emissions by more than 15 million pounds. The grid and charging infrastructure investments made for the city’s fleet transition will also support widespread community adoption of EVs by increasing the number of publicly accessible charging stations and potential sites in the city.

In addition to the community-wide environmental and adoption benefits, the transition and IRA tax credits will provide financial benefits to the city. First, the tax credits – in addition to other rebates associated with EV acquisition and charger installation – reduce the price premium of EVs over traditional internal combustion vehicles. Additionally, there are cost savings realized from the reduced maintenance and fuel cost savings of EVs over traditional vehicles. Madison’s installation of solar-powered chargers will reduce charging-related costs; these installations are eligible for IRA Direct Pay credits. The financial benefits associated with the IRA tax credits, according to a report from United States Conference of Mayors (USCM) and the Center for Climate and Energy Solutions, provide for greater cumulative net benefits and shorten the time for the project to reach net benefits.

The city engineering division’s GreenPower program – a workforce program focused on preparing participants for employment opportunities in the solar energy and electrical industries – will be supporting the engineering department’s work in installing the charging infrastructure. The program hires applicants from non-traditional trades backgrounds as trainees to work alongside the department. The program is increasing the capacity of the division to accelerate the transition and providing high-quality training and skills to participants preparing themselves for a shifting labor market.

Project Funding

Madison’s most recent Executive Capital Budget & Capital Improvement Plan (CIP), covering FY 2024 through FY 2029, includes approximately $70.7M for Fleet Equipment Replacement and Electric Vehicle Charging Infrastructure via government obligation (GO) borrowing and Direct Pay rebates. The Fleet Services Department worked alongside the Mayor’s finance team to organize these components of the budget.

The CIP includes conservative estimates to reinvest $300K from IRA Direct Pay tax credits for FY 2024-2029 in procurement of EVs, in addition to $72K from IRA Direct Pay rebates to support the installation of EV charging infrastructure at city-owned sites and facilities with requisite electrical improvements to accommodate the added load. These rebates supplement planned government obligation borrowing.

Direct Pay Eligible Tax Credits To Consider for a Fleet Transition

- Credit for Qualified Commercial Clean Vehicles (45W)*

- Alternative Fuel Vehicle Refueling Property Credit (30C)*

- Production Tax Credit for Electricity from Renewables (45/45Y)*

- Low-income Communities Bonus Credit (48e/48h)*

*The section of the IRS tax code in which the credits can be found.

For more comprehensive information on the key funding opportunities that cities are eligible for, be sure to reference Clean Energy Tax Incentives: Elective Pay Eligible Tax Credits, a resource published by the Department of Treasury and the IRS.

Alongside its companion Direct Pay case story on Denver’s Climate Protection Fund, the Madison story illustrates important lessons for other cities considering using Direct Pay for capital investments related to energy and climate action.

- Review climate action/local sustainability plan and priorities; ensure that it is up to date, reflecting new opportunities from the IRA

- Foster collaboration across departments where climate action plans and investments engage various departments

- Ensure that investments/projects comply with requirements for applicable bonus tax credits

- Determine how Direct Pay rebates will be reflected in the local budget and identify a method for financing up-front capital costs

Conclusion

Direct Pay is an innovation within the realm of public finance for climate projects – providing a mechanism by which tax-exempt entities, including cities, can monetize the tax credits that have been previously available only to tax-paying, private entities. Amidst ongoing investments in their fleet electrification, Madison now has the potential to further leverage their resources to advance their fleet transition and support community-wide adoption of EVs.